Key Highlights

- The Ethereum price has fallen below the $2,000 mark, impacting many investors and institutions.

- Broader market instability, including Trump’s tariff policies, pressured the price of Ethereum.

- Despite the gloomy attitude in the short term, ETH coin experienced $1.8 billion in net outflows last week. This demonstrated long-term investor trust.

Ethereum price has slipped below the psychologically significant $2,000 barrier. Its decline continues a multi-month trend while the broader cryptocurrency market suffers.

Since December 18, ETH price have fallen by more than 50%. As a result, many investors’ portfolios suffered large losses.

Among those affected is World Liberty Financial (WLFI), founded in 2024. It has seen a staggering $110 Million drop in its cryptocurrency holdings. In its decline, the ETH crypto alone accounts for 65% of these losses, making it the primary driver of WLFI’s decline.

This situation has created chaos in the market, particularly as a project associated with Donald Trump faces such substantial losses. Experts are now questioning the viability of crypto reserves, especially as a presidential-backed initiative falls victim to global market downturns.

Despite these challenges, WLFI remains optimistic about the future potential of cryptocurrency technologies. Moving ahead, it continues to invest heavily in digital assets.

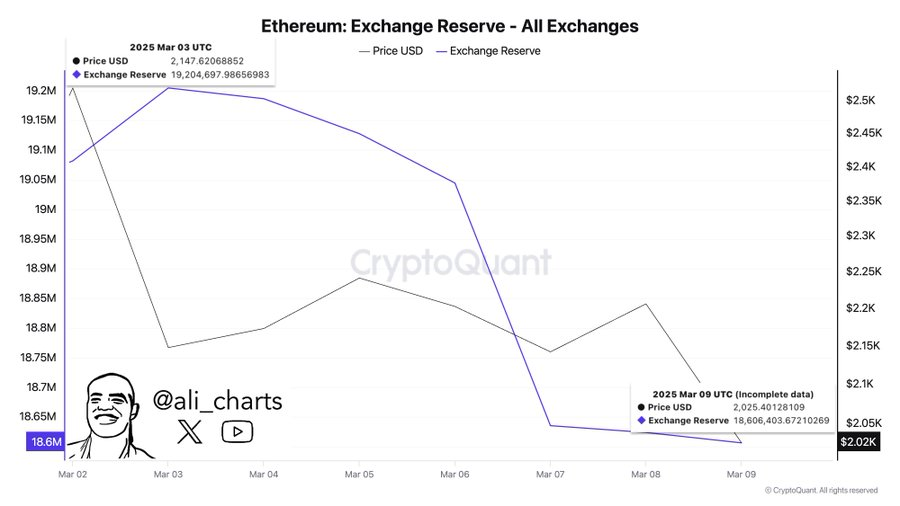

Interestingly, Ethereum exchange outflows have steadily decreased even amid the crash, which typically signals bullish sentiment. However, the overall market sentiment remains bearish, leaving many to wonder how the situation will unfold.

Global Issues Adding Weight To Falling Ethereum Price

The recent downturn of the Ethereum price occurred against a backdrop of broader macroeconomic instability. The S&P 500 has dropped over 450 points since hitting an all-time high on February 19. It is reflecting a growing risk-off sentiment among investors.

President Donald Trump’s recent tariff policies on U.S. trading partners have further fueled uncertainty. It is affecting both equity and cryptocurrency markets.

With institutional investors exposed to both sectors, the ETH price remains susceptible to fluctuations in traditional markets.

Similarly, the Kobeissi Letter highlighted a significant shift in market sentiment. They further noted that the crypto markets have lost $1.2 Trillion in just three months.

This underscores the severity of the current conditions, which have led to numerous deep red days and increased volatility.

Despite the pessimism surrounding the Ethereum price, many holders view the current levels as a strategic buying opportunity.

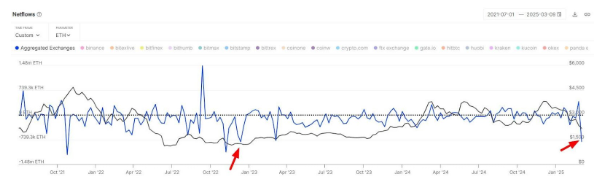

Data from IntoTheBlock indicates that ETH crypto saw its highest net outflows from exchanges last week since December 2022. It totaled around $1.8 Billion.

Adding to this trend, over 600,000 ETH exited centralized exchanges last week. This further suggested that long-term investors remain confident in ETH crypto’s fundamentals.

This movement could signal a potential shift in sentiment as investors position themselves for future gains.

Where is Ethereum Price Headed Next?

The current macroeconomic situation in the U.S. is fierce. Experts warn of rising recession risks that could lead to a prolonged downturn for major cryptocurrencies.

The cryptocurrency market is experiencing a bloodbath, and the ETH price is being pushed to the brink. Recent supposed catalysts for a bullish crypto market have failed to spark any meaningful recovery.

The list of these catalysts includes the announcement of a U.S. strategic Bitcoin reserve and a national crypto stockpile. As a result, bears are firmly in control.

Moving ahead, the risks are heavily scaling toward a further decline in the Ethereum price in the coming weeks and months. Also, the known $2,000 mark has emerged as a critical long-term support and resistance level, is broken.

The recent break below this threshold is significant. ETH price has lost its grip on major moving averages. This left little support until the $1,600 to $1,500 range.

With an unfavorable macroeconomic environment marked by rising uncertainty, the near-term outlook for the ETH crypto seems bearish. For traders, exiting the market may be a safe strategy.

However, this isn’t the end for the Ethereum price in the long run. As the leading DeFi chain in the industry, the ETH crypto is backed by influential players. This includes BlackRock and insiders from the Trump administration, many of whom are long-term holders.

ETH and the broader crypto market need a favorable shift in macro conditions. As with numerous bullish narratives surrounding crypto, all that’s required is for the macro environment to improve for a potential turnaround.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.