Highlights

- A brief recovery occurred in early March after Trump’s crypto reserve announcement, but lack of buying interest led to a quick reversal.

- The SEC’s acceptance of a Bitwise Dogecoin ETF application has sparked speculation about its potential impact on DOGE’s price.

- On-chain data shows a surge in new DOGE wallet addresses, indicating growing adoption, with addresses doubling.

The Dogecoin price has suffered with volatility over the past couple of months, particularly after reaching its yearly peak in December 2024. Following this high, the DOGE price began to fade, adhering to a downward dynamic trendline.

The decline intensified when the Dogecoin price retested this trendline for the second time, encountering a high-volume supply block that pushed the price down sharply. This movement ultimately led to a break below a key support level around $0.3055.

In early March, its market recovered briefly after Trump announced plans for a U.S. crypto reserve, causing the price to rise to $0.2400. But, the lack of fresh buying interest from them resulted in a quick reversal the next day, with the price dropping from the 20-day EMA band.

In the days that followed, the DOGE price continued its fall until it reached a historically significant support level at $0.1456 on March 11. Following the Bitcoin price surge, DOGE crypto has reacted positively, climbing nearly 21% in the past 48 hours.

Now, it’s at a critical juncture, with experts debating whether it is on the verge of a recovery or if the downtrend will persist.

Dogecoin Price to Rise Amid Positive ETF News?

The SEC has accepted an application for a Bitwise Dogecoin ETF. Consequently, speculation about the impact of the regulator’s nod on the crypto’s price is rising.

DOGE was trading within a narrow range, but it is now experiencing a resurgence of bullish sentiment, driven by broader market trends and positive technical signals.

The SEC’s acceptance has generated significant buzz in the crypto community, with the news being shared widely on X by crypto enthusiasts like the CEO.

In a post that quickly gained traction among traders, the CEO underlined this feat. The ongoing stabilization in the DOGE crypto may be due to the stabilizing overall crypto sector and this DOGE news. Alongside DOGE, the BTC has been pushed back above the $80K mark after dipping to $77K.

If all things in Dogecoin ETF process ends smoothly and an approved ETF goes live. Then it could pave the way for increased institutional investment.

While the SEC has yet to approve the product, speculation is mounting about its potential impact, drawing parallels to the journey of Bitcoin’s ETF.

DOGE Price Decline Attracts New Addresses

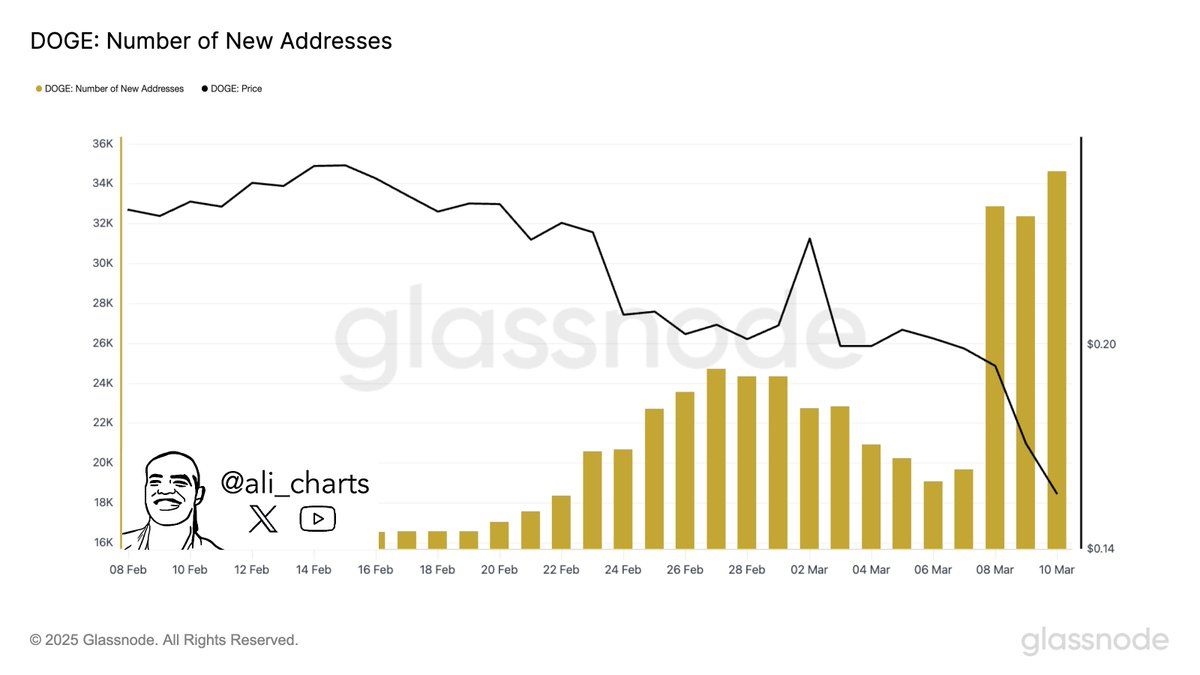

Alongside positive Dogecoin ETF news, its on-chain data pointed towards rising optimism. Recent on-chain data from Ali’s post reveals a significant surge in network activity for Dogecoin.

Over the past month, there has been a marked increase in new DOGE wallet addresses, indicating growing adoption of the token.

On February 8, the number of addresses stood at 16,400, but by March 10, that figure had doubled to 34,600.

This uptick in network activity suggests that DOGE crypto is gaining popularity, even amid price declines. As more users engage with the network, market participants are watching closely to see how this trend may influence future Dogecoin price trajectory.

Analyst Projects $2.80 Dogecoin Price Target on Weekly Chart

Furthermore, price forecast from Trader Tardigrade, a prominent analyst on X, has attracted significant interest in the community.

Per his post, he has highlighted the significance of the 100-week SMA in evaluating the Dogecoin price trends.

His analysis indicates that DOGE price has historically entered strong bullish phases after breaking above this long-term resistance level.

The latest chart shows that the Dogecoin price has once again touched the 100-week SMA, a crucial point that has previously led to major price movements.

He further explained, that during the 2017-2018 bull cycle, Dogecoin price remained below the 100-week SMA until a breakout in early 2017 sparked a substantial rally. After reaching a peak, DOGE price retraced but found support at this same dynamic level.

Similarly, he continues and highlights that an similar pattern also occurred during the 2020-2021 bull run, where Dogecoin price surged after crossing the 100-week SMA.

Following its peak, DOGE price retraced but continued to test this support level throughout 2022 and 2023.

Per the analyst, the DOGE price has reached this highlighted critical level once more, as indicated by a thumbs-up symbol on Trader Tardigrade’s chart.

Additionally, he says that if history is any guide, a breakout could propel the Dogecoin price toward $2.80. However, past rejections from this level, marked by downward arrows on the chart, suggest that failing to break above the SMA could result in further declines or sideways movement.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.