Highlights

- The CME will launch Solana futures contracts on March 17, potentially increasing liquidity and attracting long-term investors.

- Analysts suggest the Solana price is forming a cup and handle pattern, which could lead to a price surge toward $3,800 if the trend continues.

- An analyst hints at a critical support range for Solana price, with a breakdown potentially triggering a 30% to 40% correction.

The Solana price has been experiencing notable fluctuations, primarily driven by a sharp decline in memecoin trading and shifting macroeconomic conditions. This volatility has seen the SOL price drop nearly 60% from its peak of $295 to a low of $112.

However, in recent days, it has managed to climb back above the strong support level of $120, thanks in part to a stabilizing crypto sector, including BTC price crawling back on its knees above the $80K mark after a lethal dip to the $77K mark.

Looking ahead, Solana crypto may receive an additional boost from an upcoming positive development in next few days. As this event approaches, numerous expert analyses have emerged regarding the next Solana price targets.

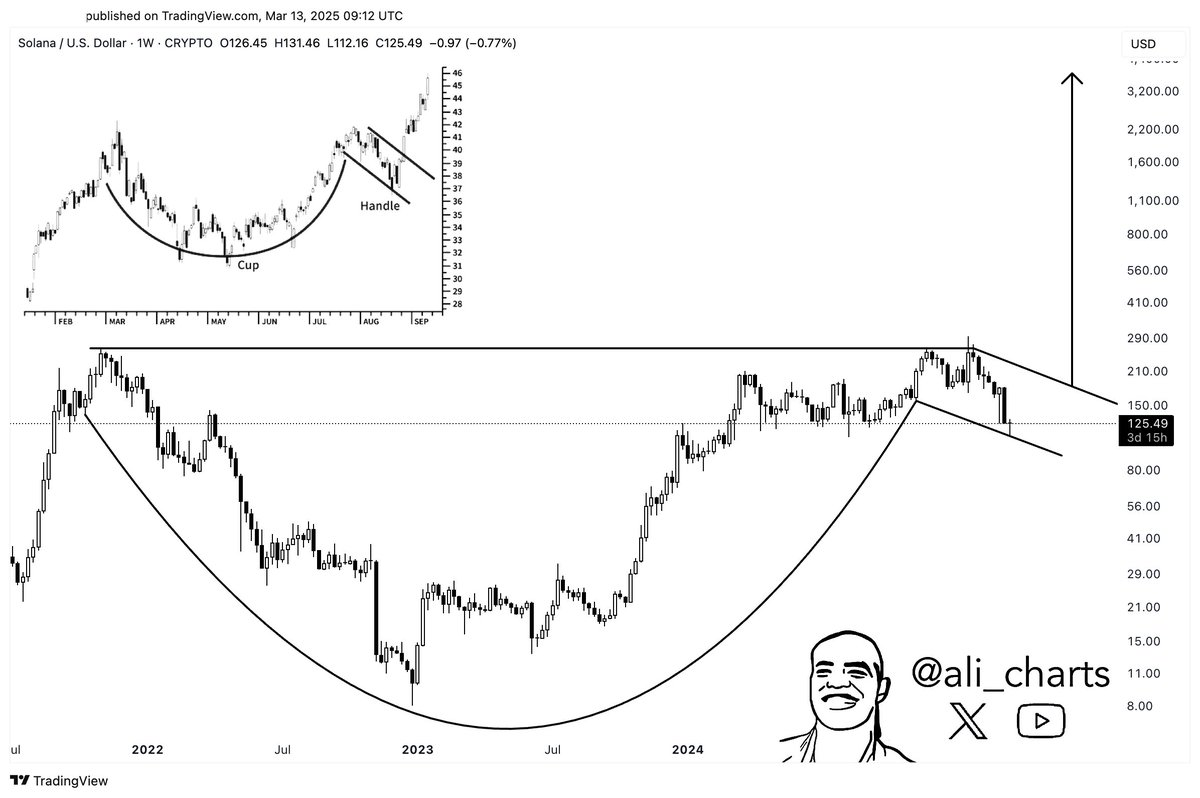

Among them, one particularly compelling theory suggests that Solana crypto is forming a cup-and-handle pattern on the weekly price chart. This pattern is a technical formation that typically indicates a bullish outlook.

After recently trading at $112, the lowest point in the past year, the Solana price has begun to recover. If this pattern continues, it could pave the way for a significant rally in the near future. Keep reading to know more.

Solana Crypto’s Future Contracts Launch On The Horizon

The Chicago Mercantile Exchange (CME) is set to launch Solana futures contracts on March 17, marking one of the first regulated Solana futures products in the U.S. This follows Coinbase’s earlier introduction of Solana perpetual contracts this year.

The introduction of futures contracts often leads to increased liquidity and reduced volatility, which could enhance or stabilize the Solana price further while attracting long-term investors. The upcoming CME futures are expected to further improve market sentiment around Solana crypto.

Analyst’s Outlook On Solana Price Highlights Optimism

Ali Martinez recently shared a weekly chart for SOL/USD, highlighting a rounded bottom that forms the “cup,” followed by a slight downward drift that creates the “handle.”

If this pattern holds, Solana price could potentially surge toward $3,800, representing a staggering 2,940% increase from its current price of $125.

After experiencing five consecutive days of losses, the Solana price recently dropped to $112, bringing it close to a multi-year support level. The $110–$125 range is critical, and maintaining this zone could be pivotal in determining the next trend direction.

Moreover, market analyst Ted Pillows noted that Solana is currently retesting this multi-year support zone. A breakdown below this level could trigger a significant correction of 30% to 40%.

Adding to the bearish sentiment, Solana price has formed a death cross on its daily chart. This pattern suggests downside risk if bulls fail to defend the critical support level. Should the price fall to $110, it could further decline to around $80.

However, Pillows also pointed out that Solana is testing a major uptrend support level that has historically provided solid backing for its price. If SOL price can remain above this trendline, bulls may regain control and mitigate the impact of the death cross.

As of now, the Solana price is trading at $133.28, reflecting a 7.62% increase in the past 24 hours. Its market capitalization stands at $6773 billion.

With a circulating supply of 509.55 million SOL, the trading activity remains robust, indicating ongoing interest in the asset.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.