Key Insights

- Ethereum price dropped over 4.20% intraday and struggles near $2000 mark.

- Ethereum has a strong hurdle placed around $2460 where bears made a strong grip.

Ethereum (ETH) price continues to face significant bearish momentum and struggles to climb past the $2300 mark.

Despite a sharp rebound over 10% from the $2000 support zone this week, the mighty bulls failed to gain dominance and ETH price faced significant rejection.

At press time, ETH price was trading at $2180 with an intraday decline of over 4.20%. Its market cap stood at $263.66 Billion and the trading volume dropped over 12.9% intraday.

Amidst the growing uncertainty about its recovery potential, Ethereum price witnessed increased selling pressure and trades below its key EMAs.

Both technical indicators and on-chain data suggests that bears have made their upper hand and further declines may be on the horizon unless it breaks above the $2460 hurdle.

Ethereum Whales Load Up: is a Price Rebound on the Horizon?

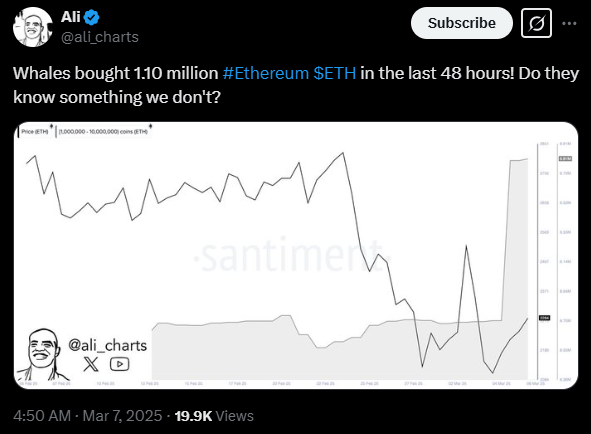

A recent post by Ali Charts on X highlighted that Ethereum whales conduct a substantial buying activity of 1.10 million ETH within the last 48 hours.

The sharp price raised speculation about potential market insights held by these whales. The surge of whale activity might indicate both optimistic predictions about Ethereum’s future performance as well as hints of upcoming major events.

As investors are actively moving funds across different price levels and continue to accumulate ETH near the demand zone of $2000, a significant rebound could soon take place.

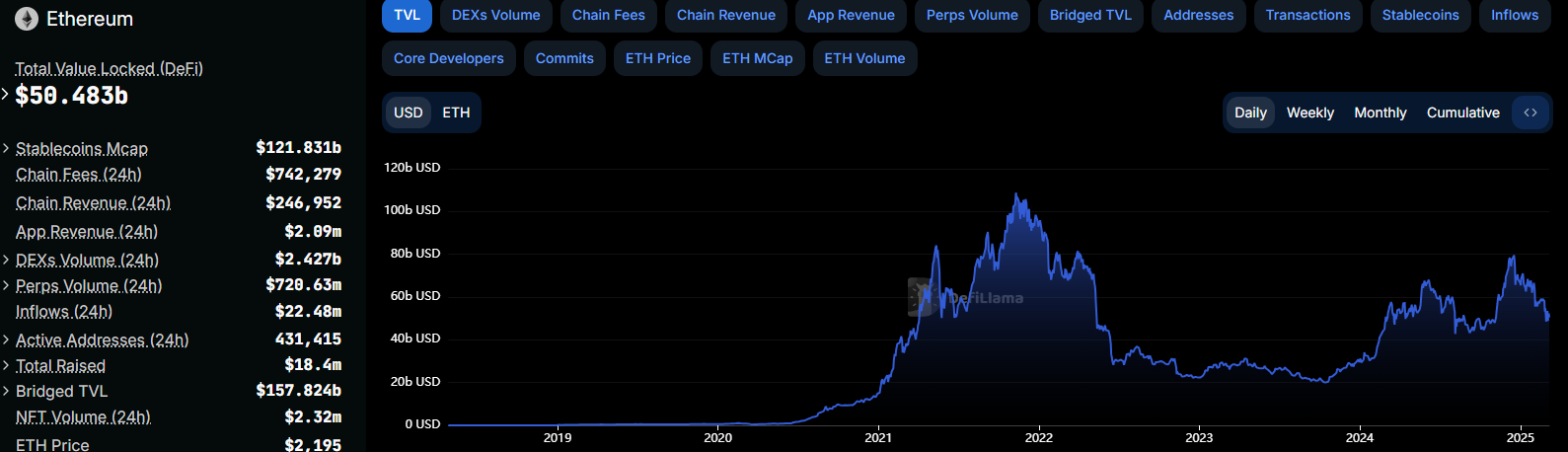

Amidst the significant price correction, Ethereum’s Total Value Locked (TVL) recorded a decline over 27% and dropped to $97 Billion in February.

At press time, ETH’s TVL stood at $50.483 Billion witnessing capital outflows and liquidity shift from the network.

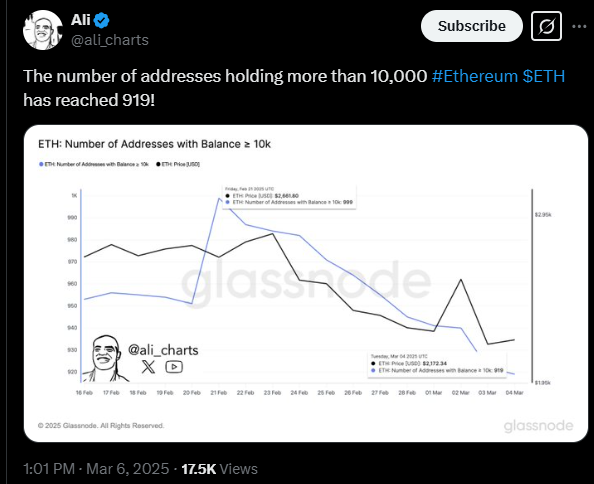

However, Ethereum addresses that hold more than 10,000 ETH don’t appear to be panicking and likely to hold their positions and maybe even accumulate in the event of further market downturns.

Ethereum Price Prediction: What are the Charts Saying?

Ethereum price prediction reveals a bearish outlook and hints indecision among market participants.

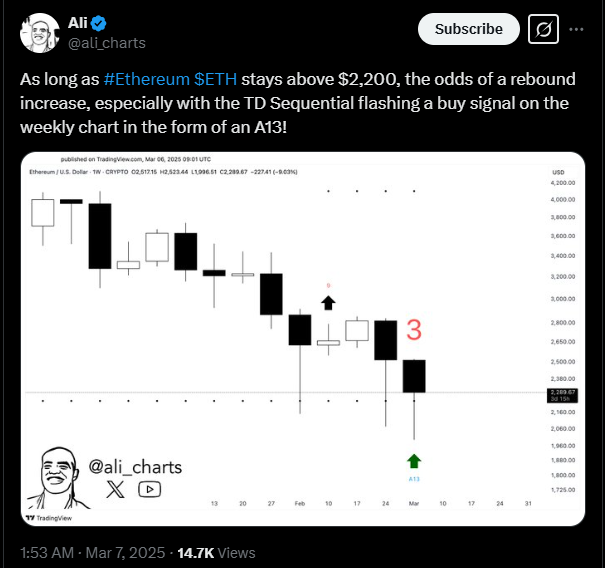

However, a recent post by Ali Charts highlighted that the TD Sequential indicator flashed a buy signal on the weekly chart.

Meanwhile, the odds of a rebound only confirms if Ethereum price remains above the $220 level.

If bulls succeed to gain bullish momentum and move past the $2300 zone, it could bounce toward the $2460 zone.

Data from IntotheBlock highlights that, Ethereum price has a strong hurdle placed at $2460, where 10.95 million investors acquired 64.52 million ETH.

If ETH price surpasses this zone, a major rally toward $2600 take place in the coming sessions

Ethereum ETF Outflows Signal Growing Market Uncertainty

Ethereum has witnessed both bearish sentiment and unfavorable market movements in the past few sessions. Ethereum lost $63.63 Million through its spot-exchange traded funds (ETFs) on March 5th.

The observed data indicates robust negative sentiment about ETH’s price performance. It suggests institutional investors steering away from Ethereum are retrieving their Ethereum investments.