Key Insights

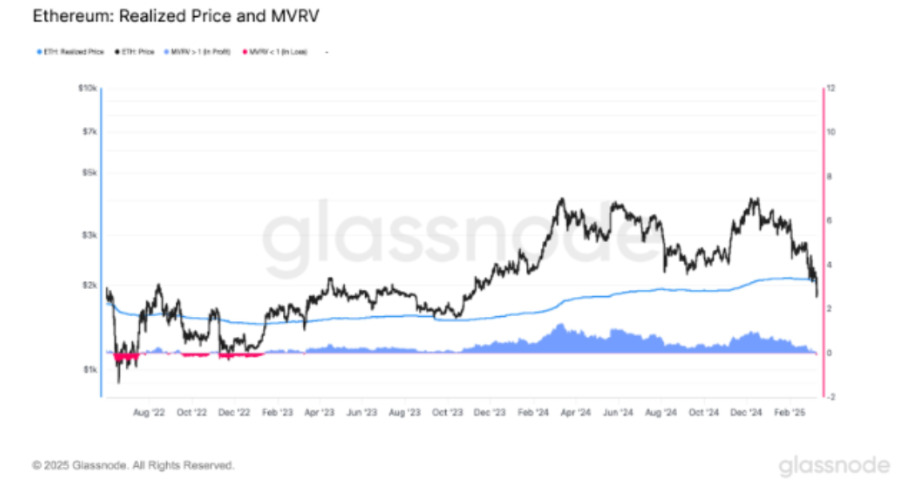

- Glassnode reports ETH below 2-year realized price with MVRV at 0.93

- Ted Pillows predicts ETH may test $1,600 to $1,800 support zone

- CryptoRank says only 47 percent of ETH holders remain in profit.

Following a sharp drop toward the $1700 demand zone, Ethereum price showcased a dead cat bounce and was preparing to retest the $2000 hurdle.

At press time, Ethereum price was trading at $1917 with an intraday rise of over 0.89%. Its market cap stood at $231.20 Billion and has a total supply of 120.6 Million.

ETH Price Falls Below Realized Price: Are Investors in Trouble?

Ethereum price dropped below its realized price level for the first time in 24 months. Currently, ETH price trades at $1900 yet investors hold their ETH at an average price of $2058.

The majority of Ethereum holders now experience negative holdings value as their tokens keep a lower price than their buying values.

The latest MVRV ratio of 0.93 from Glassnode indicates Ethereum investors have sustained an average 7% unrealized price drop.

During price fluctuations traders typically maintain their coins rather than giving them up at a loss because they believe prices will rebound.

The market stagnation could continue as a result of reduced buying activity caused by investor losses.

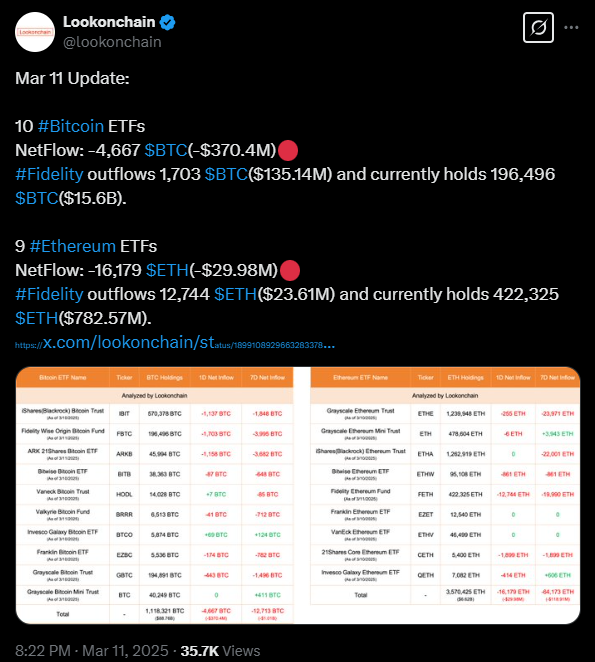

Adding to the pressure, data from Lookonchain shows that Ethereum is seeing significant sell-offs.

The total amount of ETH worth about $30 Million exited exchange wallets within a single day.

The withdrawal of 12,744 ETH worth $23.61 Million by Fidelity provides evidence that institutional investors demonstrate extreme caution in their investment decisions.

The large Ethereum holdings of Fidelity amount to 422,325 ETH ($782.57 Million) yet recent sell-offs reveal investors taking a defensive approach in the market.

Ethereum Struggles as Profitability Rate Falls to 47%

ETH price stagnating under $2,000 has resulted in deteriorating market sentiments among investors.

A CryptoRank analysis shows that 47% of individuals who own ETH have positive profit margins.

ETH experienced a significant shift in market dynamics since reaching upper levels of $3,500 only a few months ago while investors maintained positive positions.

Ethereum’s Joe Lubin expresses strong optimism about the token’s long-term prospects, despite the current market turmoil. “Perhaps never been more bullish,” Lubin noted.

Ethereum Price Prediction: What’s Next for ETH?

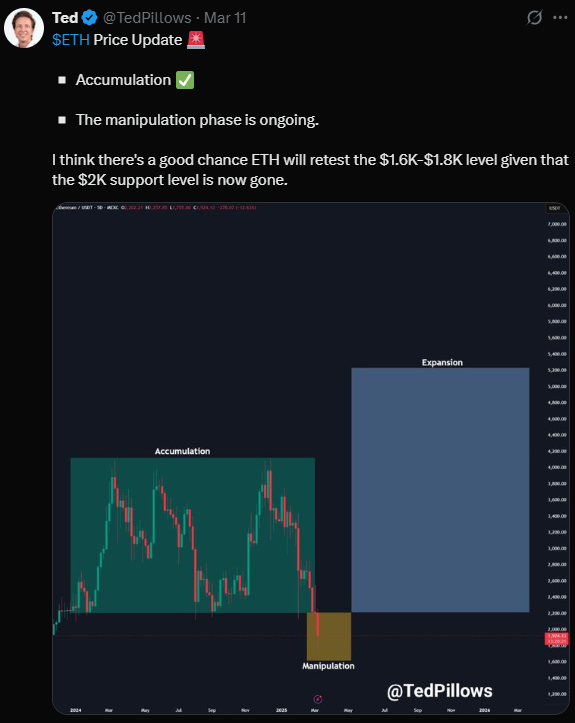

The price of Ethereum has dropped below the $2000 support zone. A recent post by Analyst Ted Pillows pointed out that Ethereum is likely headed toward the $1,600–$1,800 range—an area that’s historically been a major battleground for buyers and sellers.

If ETH price can hold steady there, it could set the stage for a bigger recovery, possibly pushing back above $5,000 in the long run. But if this support doesn’t hold, things could get messy fast.

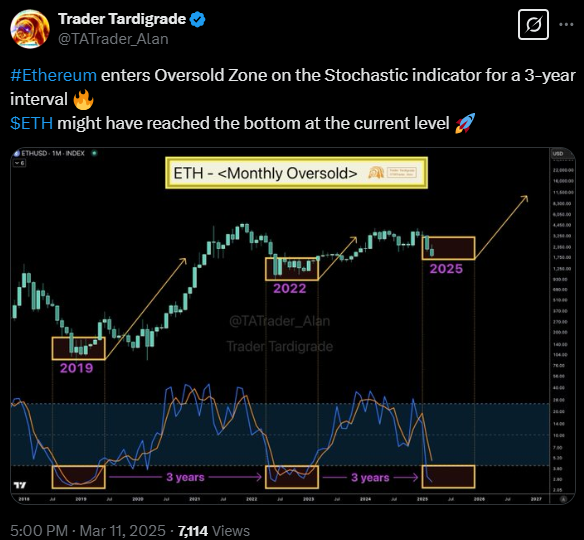

The market sentiment remains mixed, yet there are investors who hold optimistic views. Crypto Analyst Trader Tardigrade noted that ETH recently entered an oversold zone on the Stochastic indicator for a 3-year interval.

Historical data demonstrates that when these underpriced zones develop they introduce massive rebound. Ethereum may soon trigger a major rebound based on previous market behaviour.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.