Key Insights

- Investors withdrew $1.8 Billion worth of ETH from exchanges, signaling accumulation.

- Traders face $235 Million in ETH long liquidations as prices drop sharply

- Ethereum’s price slips below the $2000 mark, revealing panic among traders.

Since hitting a 52-week high of $3700 at the start of 2025, Ethereum (ETH) price has experienced a sharp decline. It has dropped over 50% in the last two months and struggles below the $2000 mark.

At press time, ETH price was trading at $1890 with an intraday decline of over 8.07%. Its market cap stood at $227.93 Billion, and it has a total supply of 120.6 Million.

Ethereum Sees Record Exchange Outflows: Sign of a Supply Shock?

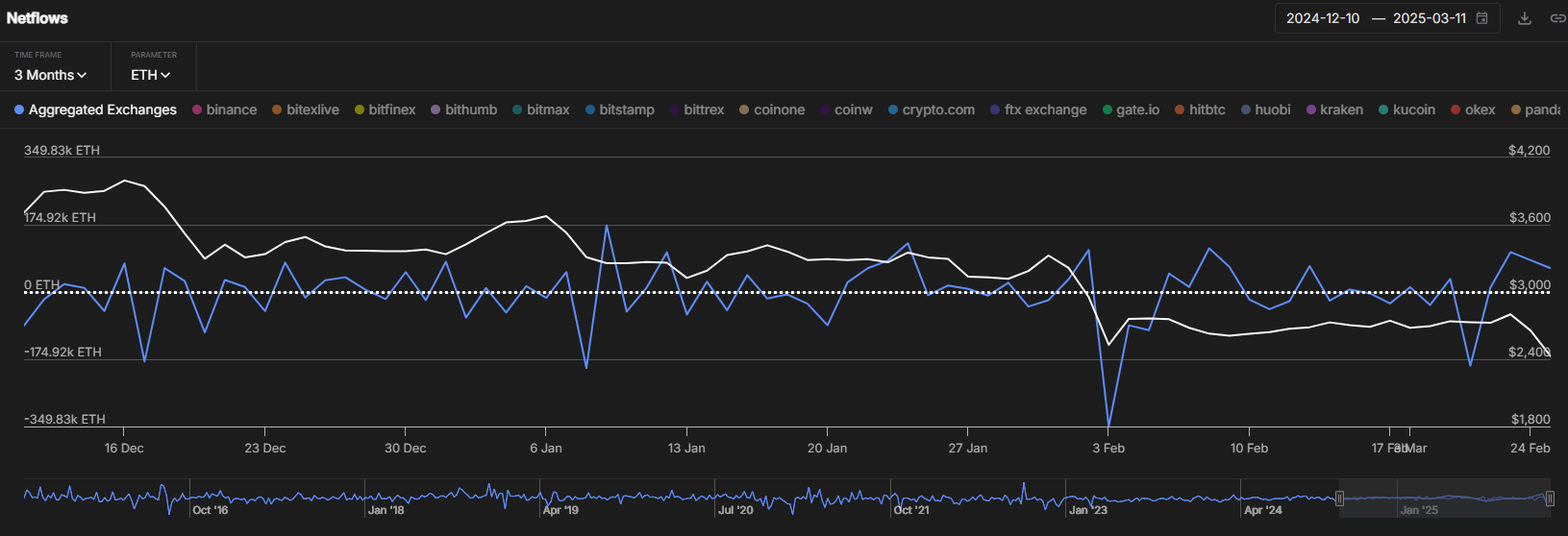

During the past week, Ethereum experienced its biggest exchange withdrawal. A significant withdrawal of $1.18 Billion worth of ETH occurred when investors withdrew their funds from exchange platforms.

IntotheBlock data revealed that investors are moving their crypto holdings to private wallets rather than keeping them on exchanges. The latest exchange withdrawal marked the highest amount since December 2022.

The negative ETH exchange netflows indicate investors avoid selling their assets. Historical data shows that price bottoms emerged during these market events. Big upward price movements will further accompany this in the upcoming months.

Ethereum price growth potential bolsters during accumulation periods because demand remains constant or grows. Exchange reserves diminish steadily while the ETH price trades at approximately $1,500.

Market mood, together with external variables, will influence Ethereum price trajectory. This could be perceived as the current supply reduction pattern indicating possible price increases.

ETH Price Falls Below $2000: Mass Liquidations Follow

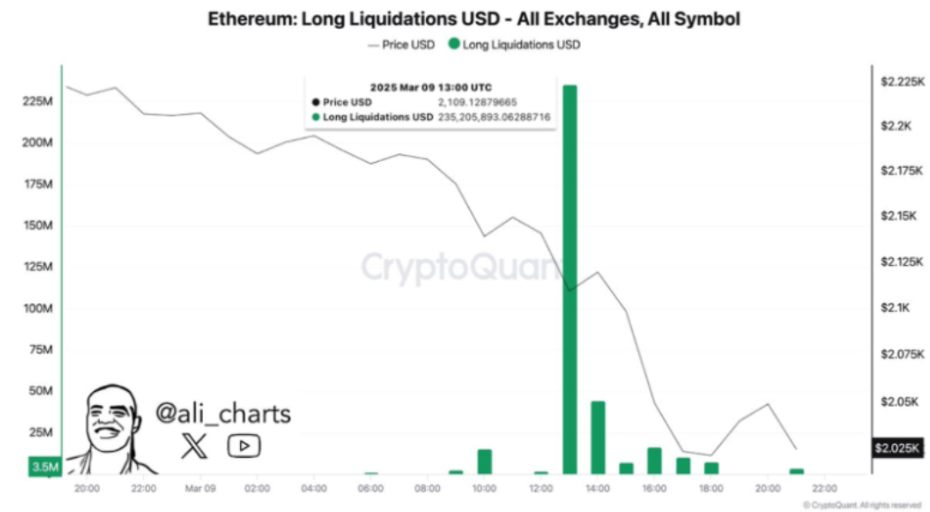

ETH experienced $235 Million worth of long liquidations on March 9, 2025, which led to a major price drop. Before the liquidation activity, ETH price stayed around the $2200 level.

Afterward, Ethereum suffered a major liquidation event at 13.00 UTC. This further pushed the market value below $2000.

When leveraged traders use automatic sell orders, it leads to long position liquidations that cause a fuel price decline.

The market price becomes volatile when it absorbs the consequences of these liquidations. Ethereum price might stabilize if buyers continue to accumulate ahead.

Ethereum Price Prediction: What are the Charts Saying?

Gert van Lagen posted on X over Ethereum. The analyst highlighted that Ethereum’s weekly time frame revealed a giant pattern of inverted head and shoulders.

Ethereum formed a right shoulder around $1800 and could see a rebound soon. In case of a successful rebound, it could target a breakout above the $4000 zone. This could pave the way toward $20,000 in the next few weeks.

However, the daily chart shows that ETH price has reached the lower trendline support of the falling channel pattern. Moreover, the Relative Strength Index (RSI) line stood at 33, underlining the oversold conditions.

If Ethereum price successfully defended the $1800 support zone ahead, a rebound toward the $2100 hurdle could be anticipated.

However, a break below the $1800 support zone could trigger the selloff’s next leg. This could push the ETH price toward $1500 in the coming sessions.

Disclaimer

This article is for informational purposes only and provides no financial, investment, or other advice. The author or any people mentioned in this article are not responsible for any financial loss that may occur from investing in or trading. Please do your research before making any financial decisions.