Key Highlights:

- Avalanche struggled to regain momentum as selling pressure dominated, with weak recovery attempts.

- Short- and mid-term holders exit AVAX, while long-term holders risk becoming bag holders.

Avalanche (AVAX) price continues to face significant bearish momentum and hovering close to the resistance zone of $20. Over the past month, Avalanche crypto dropped more than 20%, showcasing bearishness on the charts.

Both technical indicators and on-chain metrics suggest that further declines may be on the horizon unless market conditions improve quickly.

At press time, AVAX price was trading at $19.20, noting an intraday rise of over 0.33%. Its market cap soared to $7.95 Billion, ranked 16th in the crypto market.

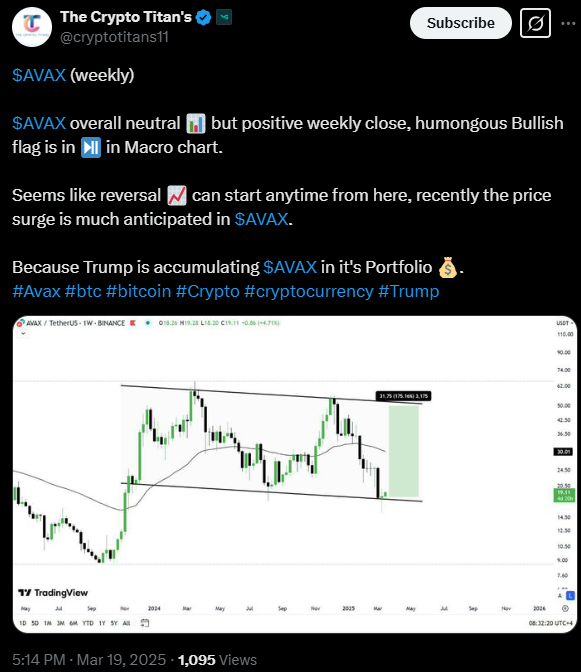

What Market Analysts Are Saying?

A recent post by The Crypto Titan highlighted that Avalanche crypto weekly timeframe data indicates a reversal possibility ahead. Currently, the token’s price was close to the support and a positive close could lead to a price surge in the next few sessions.

Amidst considerable investor accumulation, AVAX price seemed ready for an upward move. Moving ahead, a recovery could be triggered soon.

AVAX Trading Activity Insights

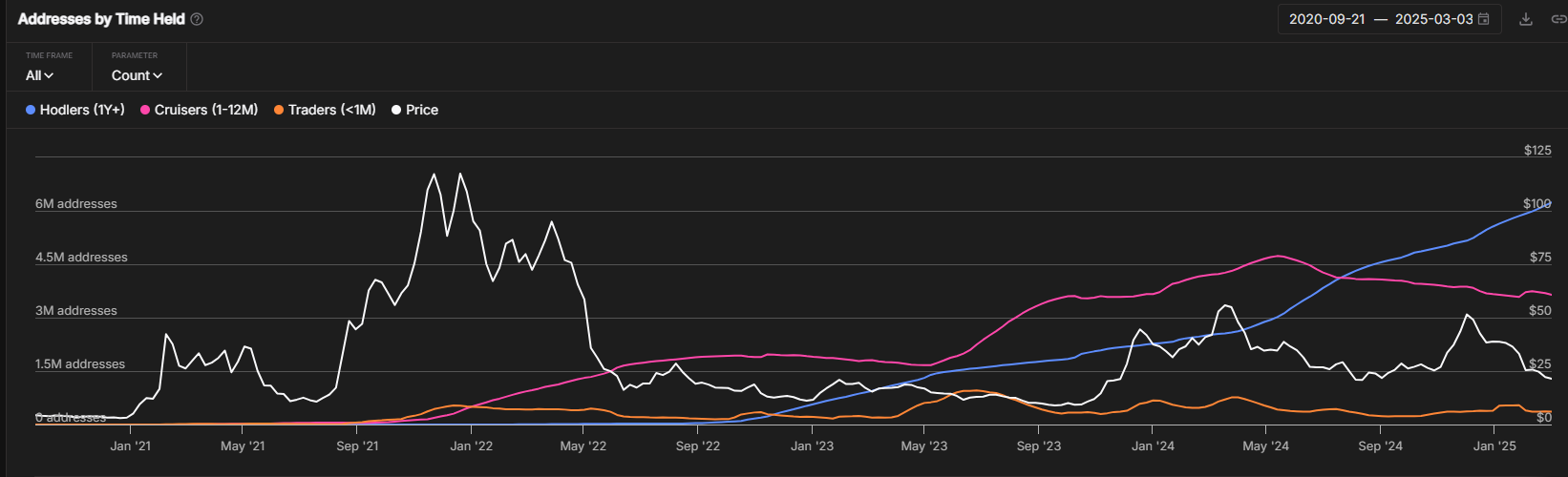

IntoTheBlock provided ownership distribution data to show how Avalanche crypto holders exhibited changing market behavior. Data showing reduced participation from short- and mid-term holders strengthens the potential market downtrend.

Cruiser investor numbers holding for one to twelve months declined by 6.32%. The available data shows that numerous holders abandoned their AVAX positions.

Additionally, traders with short-term investment horizons showed decreased participation in the market by 3.78%. A drop in trader activity signifies declining market interest that might affect trading volatility and reduce demand.

The holding pattern of investors who held for more than one year exhibited the opposite behavior. Data showed a 7.72% surge in the number of addresses, which raised their count to 6.22 million addresses.

Long-term investor retention in positions is confirmed through this data. However, this behavior also describes investors who choose to hold losing positions, hoping for eventual profits.

This practice is known as bag holding. The sentiment shift could force delayed selling by long-term holders who begin to cash out their positions.

AVAX Price Prediction: What’s Next for AVAX?

During the daily timeframe, AVAX price traded below the key EMAs and continued to form lower and low swings. It has been in a significant downtrend and was looking to cross the 20 day EMA mark.

The Relative Strength Index (RSI) line stood at 43 signals, a neutral outlook. However, it signals that the token might outperform soon, as the RSI line was on the verge of a crossover.

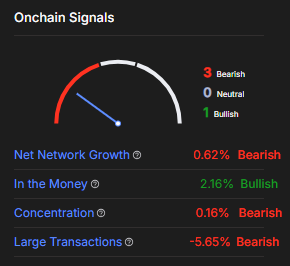

Furthermore, AVAX’s on-chain metrics reinforce the bearish outlook, reflecting reduced activity and interest.

Net Network Growth has fallen by 0.62%, signaling slower adoption within the ecosystem. Additionally, the market sentiment echoed challenges. Open Interest (OI) declined by 0.30% to $344.20 Million, replicating decreased trader participation.

AVAX will likely experience a sideways move around the $20 mark based on the technical and on-chain data. However, if it crosses the $22 mark, a significant change in trend could be seen. This might send AVAX price toward $25, followed by $28 in the upcoming sessions.

Disclaimer

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.